First, I think Thursday's action is especially critical for the large caps. If it looks like names like GERN and STEM are getting hammered again, I would recommend you strongly consider exiting your position and then think about retooling if we reach that 6800 - 7000 level in the DOW. If the Stem cell action appears positive, it signals the next leg up.

As far as the small caps, be very careful. Recently, the stock movements of this group have been very "pennylike" (and I mean that in a bad way). CBAI.OB in particular should be watched very closely. Because it finished the end of the day Wednesday 2/25/09 so strongly, I'd expect a gap up Thursday morning. The buyers will probably pour in the first 5 minutes or so of trading based the stock's history the last few months. Shortly thereafter, someone will place a fairly large sell order to take profits and one of the MM's (probably NITE) will sharply drop the price. At this point, the stock could completely turn south giving up all of its gains as stops are taken out and others panic sell. On the other side of the coin, there could be so many buyers that the dip is temporary and the stock steadies into a nice intra-day incline. Overall though, the fate of the small caps lie with large caps. If the large caps respond positively, the small caps should follow.

----------------------------------------------------------

Wow! The week of 2/16/09 - 2/20/09 was a crushing one for stem cell stocks. Aside from one sparkling day thanks to CNBC's pump of the Stem Cell Summit, this was a week to forget. Thankfully, there were only 4 trading days. After rummaging through the carnage, it appears at first glance that there may be no survivors and that the stem cell stocks are done. The stock market as a whole is in free fall and the strength of its downward slide is carrying almost every sector down with it (the exception being Gold and Silver). Dow 7000 is right in our mist and to be quite honest, I don't see a market bounce until we hit the 6900 -7000 range. Right now, that appears to be the psychological barrier that everyone seems to be waiting for. Until we get there, I see everything going lower. Fundamentally, I think stem cell stocks are still a good play, but in today's blog, I wanted to focus on where they are technically.

This chart of GERN is indicative of many of the relatively larger cap stem cell stocks. Notice the steady 2 month rise beginning around the end of November. Then, all of a sudden there was an explosion on 1/23/09 with Geron's well publicized announcement. The quick rise was unsustainable and a precipitous drop happened shortly thereafter. Presently, the stock appears to be at a crossroads. The arrows show the two possible directions in which this stock can go. It could continue on it's downward path, in which case you cut your losses and wait for a new entry point. However, the spike and drop the last month could just be "noise" or "gap filling" as GERN continues its slow ascent. If we dip to that key level in the DOW of 7000 quickly, a reversal could occur and the positive chart trend remains intact. If it takes 2 to 3 weeks for us to drop another 350 to 400 points, it may be too much to overcome for a bounce back.

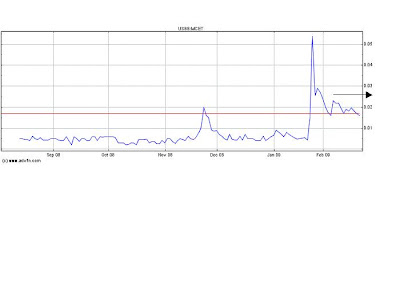

MCET's chart is indicative of many of the smaller cap stem cell stocks. The picture this chart paints is a little more negative and more defined than GERN's. This chart is setting up like a classic penny stock chart. A textbook penny stock consists of building a long term base and then a quick spike. The quick spike is usually followed by a return to the previous or new base building area. MCET seems to be back in a base building mode. However, the bright side is that the base building area appears to be at a higher level than the previous one and if things continue, it's a waiting game until the next super spike happens. Just be sure to sell at the top when it happens.

Worst Stem Cell Stock Performer(s) of the Week: